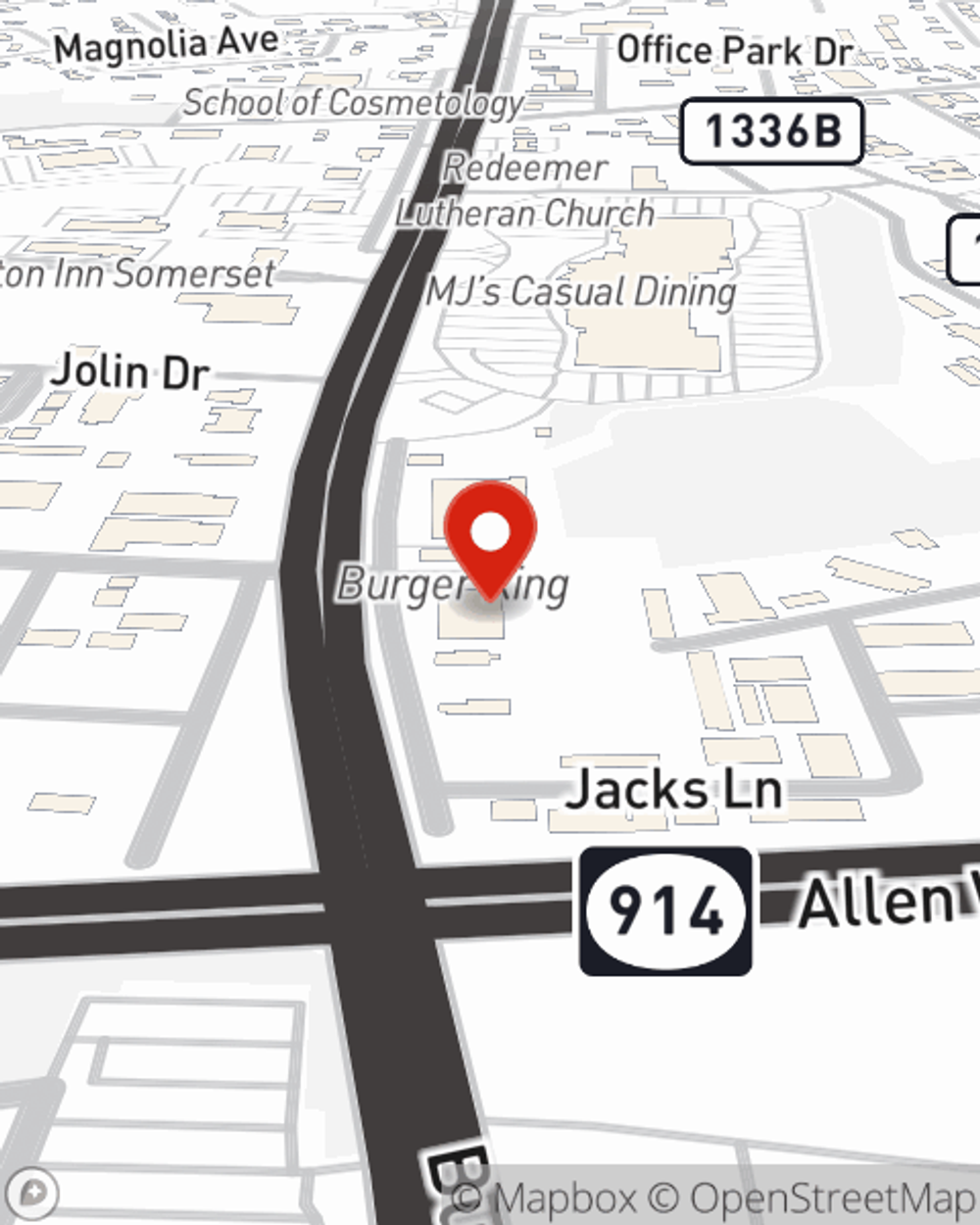

Business Insurance in and around Somerset

Somerset! Look no further for small business insurance.

Insure your business, intentionally

- Somerset

- Monticello

- Russell Springs

- Whitley City

- Pulaski County

- Eubank

- Nancy

- Burnside

Business Insurance At A Great Value!

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Ryan Collett. Ryan Collett understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Somerset! Look no further for small business insurance.

Insure your business, intentionally

Insurance Designed For Small Business

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are an HVAC contractor or a podiatrist or you own an antique store or a hobby shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Ryan Collett. Ryan Collett is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Get in touch with State Farm agent Ryan Collett's team today to discover your options.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Ryan Collett

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.